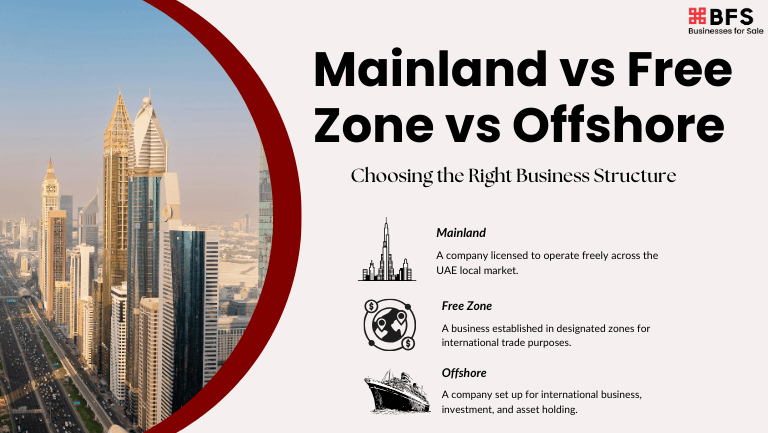

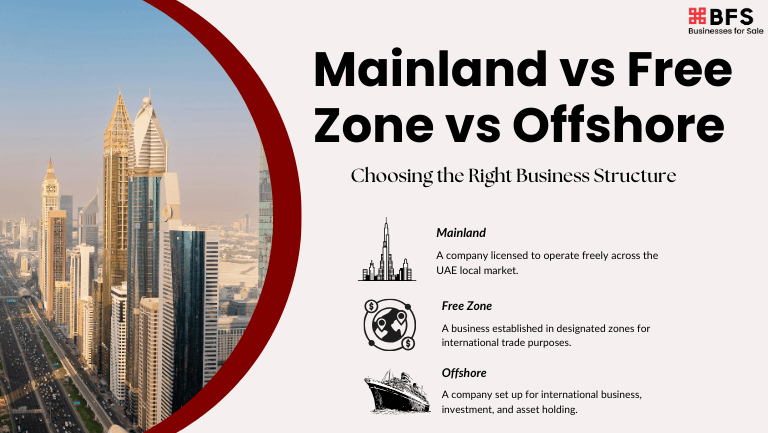

Starting a business in Dubai sounds simple until you reach the point where you must choose between the Mainland, the Free Zone, or the Offshore. This single decision affects where you can operate, who you can work with, the level of compliance you face, and how your business grows over time.

Each option comes with its own legal framework, operational rules, advantages, and limitations. Knowing these differences upfront helps businesses plan effectively, avoid unexpected restrictions, and make informed operational decisions.

This guide explains what these three areas really are, how they function as separate jurisdictions, and what it means for your business. We break down the rules, benefits, and limitations in simple, practical terms so you can understand each setup clearly and see which might suit your business goals.

Key Differences: Mainland vs. Free Zone vs. Offshore

|

Aspect |

Mainland |

Free Zone |

Offshore |

|

Market Access |

Full UAE & international |

Free Zone + international; UAE mainland requires a local agent |

International only; cannot trade in the UAE |

|

Ownership |

Up to 100% (most sectors) |

100% |

100% |

|

Business Activities |

Trading, services, manufacturing, construction, retail/wholesale |

Zone-specific: commercial, service, industrial, e-commerce |

International trading, holding assets, IP, investments |

|

Office Requirement |

Mandatory physical office |

Flexible: flexi-desk, office, warehouse |

No office; registered agent mandatory |

|

Visas & Workforce |

Investor & employee visas; hire anywhere in the UAE |

Visas linked to a license; hiring mainly in the Free Zone |

Limited visas; rules per offshore jurisdiction |

|

Taxes & Compliance |

9% corporate tax above threshold, VAT; full compliance |

Usually tax-exempt in zone; simpler compliance |

0% UAE tax; minimal compliance; offshore rules |

Understanding Mainland Companies in Dubai

A Mainland company is a common business structure in Dubai that allows full access to the local market. It is highly flexible, enabling a variety of business activities and operational freedom across the UAE. This section will guide you through its main features and considerations simply and clearly.

What Is a Mainland Company?

A Mainland company is a business licensed by the Department of Economy and Tourism (DET) in Dubai. It allows you to operate freely across the UAE and even internationally. Mainland companies can trade directly with consumers, businesses, and government entities anywhere in the country, making them highly integrated into the local economy.

This section explains the key aspects of Mainland companies in a structured way, covering ownership rules, business activities, market access, office requirements, visas, taxation, compliance, and suitability. Each part gives you a clear understanding of how a Mainland company works and what it entails.

Key Features of Mainland Companies

Below are the main areas you should know about when considering a Mainland company:

-

Ownership Rules

Mainland companies allow up to 100% foreign ownership for most commercial and professional activities. Previously, local partners were often required, but now international investors can fully own their businesses in most sectors. Some strategic industries may still need UAE national participation, but these are exceptions.

-

Business Activities Allowed

Mainland companies can carry out a wide range of activities. Common examples include:

- General and specialised trading, covering the buying, selling, and distribution of goods within the UAE market.

- Professional services such as consulting, information technology, marketing, legal, and other advisory work.

- Industrial and manufacturing operations, including production, assembly, and processing of goods for local or regional markets.

- Retail and wholesale operations allow businesses to sell directly to consumers or in bulk to other companies.

- Construction and contracting, undertaking civil, commercial, or residential projects as approved by relevant authorities.

- Multiple related activities under a single license, subject to DET approval, enabling companies to combine complementary operations efficiently while maintaining compliance.

-

Market Access and Operational Freedom

Mainland companies have broad access across the UAE. They can trade anywhere in the country, open offices in different emirates, work with government entities, and bid on public tenders. This level of operational freedom allows businesses to establish multiple branches and interact directly with local clients, providing flexibility for growth and expansion.

-

Office and Physical Presence

A Mainland company usually needs a physical office registered with Ejari. Minimum office size requirements depend on the type of activity and the number of visas needed. Companies can choose from traditional offices, serviced offices, or industrial spaces, depending on their operational needs.

-

Visas and Workforce

Mainland companies can issue investor and employee visas and scale their workforce based on office size. Hiring is not restricted to a specific zone, giving more flexibility to recruit talent from anywhere in the UAE and manage workforce growth efficiently.

-

Compliance

Mainland companies must follow DET licensing rules, Federal Commercial Companies Law, corporate tax and VAT filings, and Economic Substance Regulations where applicable. Adhering to these regulations ensures credibility with banks, clients, and government bodies and provides a transparent operating environment.

Who It Suits

Mainland companies are suitable for businesses that target the UAE market, plan physical expansion, or want to work with the government or large local organisations. The structure provides full operational flexibility but may not be ideal for businesses that prefer minimal office space, lower compliance obligations, or a fully digital model.

Mainland at a Glance

|

Aspect |

Mainland Company |

|

Licensing Authority |

Department of Economy and Tourism (DET) |

|

Market Access |

Full UAE & international |

|

Foreign Ownership |

Up to 100% (most activities) |

|

Office Requirement |

Mandatory |

|

Corporate Tax |

9% (above threshold) |

|

Suitable For |

Local-market focused businesses |

Understanding Free Zone Companies in Dubai

Free Zone companies in Dubai are special business entities set up within designated zones that cater to specific industries and foreign investors. They provide simplified setup procedures, 100% foreign ownership, and attractive tax incentives. However, they generally cannot trade directly with the UAE local market without additional

What Is a Free Zone Company?

A Free Zone company is a business entity established within one of Dubai’s Free Zones, which are designated areas created to attract foreign investment and support specific industries. Each Free Zone operates under its own authority, with separate rules, licensing procedures, and incentives. Free Zone companies generally offer 100% foreign ownership, simplified setup, and sector-focused advantages, but have restrictions on trading directly within the UAE local market

-

Types of Licenses and Business Activities

Free Zones issue licenses based on the nature of the business, commonly including:

- Commercial licenses for trading activities within the Free Zone and international markets.

- Service licenses for consulting, IT, marketing, and professional services.

- Industrial or manufacturing licenses for light production activities are allowed within the zone.

- E-commerce licenses for digital and online businesses operating across borders.

Business activities are generally restricted within the Free Zone or for international trade. To conduct business in the UAE local market, companies must partner with a Mainland entity or obtain a local distribution agreement.

-

Office and Infrastructure Requirements

Free Zone companies are required to maintain a registered office, but space requirements are flexible. Options include:

- Flexi-desks or shared workspaces for small teams and startups

- Standard offices for medium-sized operations

- Warehouses or industrial units for manufacturing and logistics

This flexibility allows businesses to scale their office requirements in line with growth and visa quotas.

-

Ownership and Workforce

Free Zone companies allow 100% foreign ownership without a local sponsor. Investor and employee visas are issued based on office size and license type. Hiring is usually restricted to the Free Zone unless additional approvals are obtained, allowing focused workforce management.

-

Tax Benefits and Incentives

Dubai Free Zones offer a range of incentives, including:

- 0% corporate and personal income tax for a defined period

- 100% repatriation of capital and profits

- Exemptions from import/export duties for goods within the Free Zone

- Simplified accounting and reporting requirements in some zones

VAT may still apply to applicable goods and services depending on the activity.

-

Regulatory Compliance

Compliance is governed by the respective Free Zone Authority, which handles licensing, visa issuance, and reporting. Companies must maintain proper records and follow zone-specific regulations, which are generally more streamlined than Mainland requirements.

-

Suitable Business Models

Free Zones are ideal for businesses that focus on international trade, export-oriented operations, digital services, or sector-specific industries. They offer attractive tax benefits, full ownership, and streamlined setup, but restrict direct trading within the UAE local market unless additional arrangements are made

Free Zone at a Glance

|

Aspect |

Free Zone Company |

|

Licensing Authority |

Specific Free Zone Authority |

|

Market Access |

Operate within the free zone and internationally, but direct trade with the UAE mainland requires a local distributor/agent |

|

Foreign Ownership |

100% |

|

Office Requirement |

Depends on the free zone license package; can be a flexi-desk or a physical office |

|

Corporate Tax |

Typically exempt within the free zone, VAT applies when trading outside |

|

Suitable For |

Internationally focused businesses, e-commerce, technology, media, logistics, and businesses not targeting the UAE mainland |

Understanding Offshore Companies in Dubai

Offshore companies in Dubai are registered in specific jurisdictions designed for international business, asset management, and investment purposes. These companies are primarily used for holding assets, protecting wealth, managing international operations, or facilitating cross-border trade. Offshore companies do not require a physical office in Dubai and cannot directly conduct business within the UAE market.

What Is an Offshore Company?

An Offshore company is incorporated under the regulations of designated offshore jurisdictions in the UAE, such as JAFZA Offshore, RAK Offshore, or Ajman Offshore. These companies are mainly used for holding investments, intellectual property, ships, or international trade operations. They offer privacy, asset protection, and simplified compliance procedures compared to Mainland or Free Zone companies.

Key Features of Offshore Companies

- Offshore companies allow 100% foreign ownership with no local partner requirement.

- They can engage in international trading, holding investments, managing intellectual property, or owning ships and other assets. Business activities within the UAE mainland are generally restricted.

- Offshore companies do not require a physical office in the UAE, but registered agent services and a registered address within the offshore jurisdiction are mandatory.

- Offshore companies benefit from zero corporate tax within the UAE and exemptions on VAT and import/export duties for international activities.

- These companies can sponsor visas, but the number is typically limited and subject to the offshore jurisdiction rules.

- Companies must comply with the specific offshore jurisdiction regulations and annual filings to maintain good standing.

- Offshore companies are ideal for businesses seeking international operations, holding structures, asset protection, or tax-efficient global investment structures.

Offshore at a Glance

|

Aspect |

Offshore Company |

|

Licensing Authority |

Specific Offshore Jurisdiction (e.g., JAFZA Offshore, RAK Offshore) |

|

Market Access |

International business only; cannot trade directly in the UAE mainland |

|

Foreign Ownership |

100% |

|

Office Requirement |

No physical office required; registered agent mandatory |

|

Corporate Tax |

0% in the UAE; VAT and import/export duties are exempt for international activities |

|

Suitable For |

Holding structures, asset protection, international trading, and global investment activities |

Conclusion

Dubai has a range of business setups to suit different needs. Take your time to explore Mainland, Free Zone, and Offshore options and understand their rules and features. Learning about ownership, activities, offices, visas, and taxes will give you confidence. With the right knowledge, you can make smart decisions and set your business up for success.

.png)

.png)

Sharing Is Caring!